Cuyahoga County property records are key for anyone buying or investing in property. Property values here are set to rise by 32% soon. It’s vital to have the latest property records.

The Cuyahoga County auditor’s website makes it easy to search for property info. You can find deeds, mortgages, and liens. Using these records helps you make smart investment choices.

Deeds, mortgages, and liens are common in property records. Ohio records include property address, legal description, and owner info. The Cuyahoga County auditor’s office keeps these records up to date.

This makes it simple to search for property owners. With online records and the auditor’s search, finding property info in Cuyahoga County is easy.

Search Cuyahoga County Property Ownership Records

Note: If the ownership records tool is not working, it could be a temporary error. Please try again in 30 minutes.

Cuyahoga County Property Ownership Records

Cuyahoga County property records are key for anyone in real estate. They show a property’s details like address and who owns it. The Cuyahoga County Real Property Department keeps these records up to date.

What Property Records Include

These records have lots of info. They show property values, taxes, and special assessments. They also list who owned the property before and when they sold it.

Types of Available Documentation

There are many types of property records in Cuyahoga County. These include:

- Deeds

- Mortgages

- Property tax records

- Assessment records

Importance of Official Records

Official records are vital for buying, selling, or investing in property. They help make sure all transactions are clear and fair. Knowing about property records helps people make smart choices in real estate.

| Document Type | Description |

|---|---|

| Deeds | Records of property ownership transfers |

| Mortgages | Records of property loans and financing |

| Property Tax Records | Records of property tax payments and assessments |

Online Tools for Property Searches

Cuyahoga County has online tools for property searches. These tools help property owners, buyers, and researchers find the information they need. The Cuyahoga County Auditor’s office offers a user-friendly platform for searching property info. This includes a GIS mapping tool and plat searches.

Some key features of these tools are:

- Access to over 550,000 active parcels in the property records database

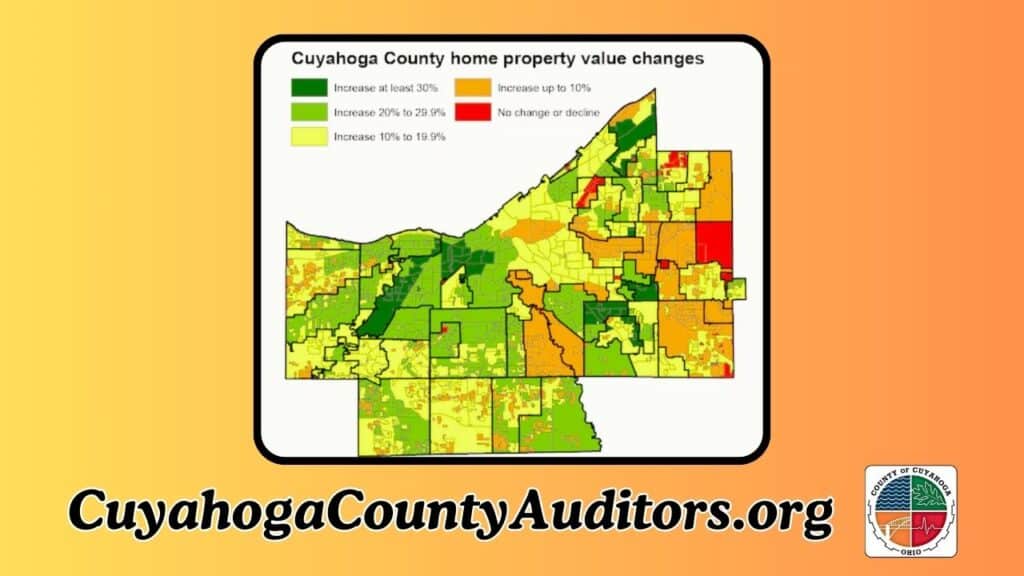

- Property value information, including a 32.22% increase in residential property values

- Online property records, including deeds, liens, and tax records

- GIS mapping tool for visualizing property boundaries and locations

These tools make it easy to search for properties online in Cuyahoga County. You can use property search tools to find what you need. With online property records, you can access information quickly and easily from home or office.

| Property Type | Property Value Increase |

|---|---|

| Residential | 32.22% |

| Commercial | 8.45% |

| Industrial | 8.49% |

The Cuyahoga County Auditor’s Office Resources

The Cuyahoga County Auditor’s office offers many resources and services. They help with property searches and understanding property records. With over 1 million parcels and more than 550,000 active ones, they manage a huge amount of data.

The online property search tool was used a lot in 2023. It was used for 945,623 searches and 1,287,459 queries. This shows how important it is for property searches.

People can search properties in different ways. They can look up properties by address, owner name, or parcel number. It’s key to understand the search results, as they give important info on who owns the property and its tax history.

The office also helps with getting copies of property records and other documents. This is through their document request procedures.

Available Search Methods

- Search by address

- Search by owner name

- Search by parcel number

Search Results

Search results give info on who owns the property and its tax history. It’s important to understand these results to make good decisions.

Document Request Procedures

People can ask for documents like property records and tax bills. The office has different ways to request these documents, online or in person.

| Document Type | Request Method |

|---|---|

| Property Records | Online or In-Person |

| Tax Bills | Online or In-Person |

Property Tax Information and Ownership Verification

Knowing about Cuyahoga County property tax and how to verify ownership is key for property owners. The tax is based on a property’s market value. Homeowners might get a Homestead Exemption. You can find property tax info, like value, tax amount, and payment history, to verify ownership.

Having property tax info is vital for verifying ownership. It helps you know your tax duties and pay the right amount. Here are important points about property tax and ownership in Cuyahoga County:

- Property tax rates: The tax rate in Cuyahoga County is 2.08% of the property’s value.

- Property valuation: The Cuyahoga County Appraisal Department values about 570,000 parcels regularly.

- Ownership verification: You can check ownership by looking at property tax info and your property’s details.

Understanding Cuyahoga County property tax and ownership verification helps you pay the right taxes. It’s also key to verify your ownership. This info is vital for making smart decisions about your property and avoiding tax problems.

| Category | Description |

|---|---|

| Property Tax Rate | 2.08% of the property’s assessed value |

| Property Valuation | Periodic valuation of around 570,000 parcels |

| Ownership Verification | Access to property tax information and property details |

Using the Recorder’s Office Database

The Cuyahoga County Recorder’s office has a huge database of property records. It goes back to 1810. This is great for finding property info, like deeds and mortgages.

To use the database well, knowing the document types and search tips is key. It has many documents, like property deeds and mortgages. With the right search tips, finding what you need is easy.

Accessing Historical Records

Historical records in the database are very important. They show who owned properties and when. You can look at them online or in person at the Recorder’s office.

Document Types Available

The database has many document types, including:

- Property deeds

- Mortgages

- Liens

- Other property-related documents

Search Tips and Strategies

To make the most of the database, use good search tips. Look for specific keywords, like addresses or owner names. Also, filter by document type or date.

Owner Occupancy Credits and Property Tax Benefits

Homeowners in Cuyahoga County can get a break on their real estate taxes. The owner occupancy credit lowers taxes for those who live in their homes. This can save a lot of money, making it a great deal for homeowners.

Cuyahoga County also has other tax benefits. The Homestead Exemption, for example, cuts taxes for seniors, the disabled, and some surviving spouses. You must meet income rules to qualify.

Some key benefits include: * Lower real estate taxes for eligible homeowners * Savings on property taxes with the owner occupancy credit * Programs like the Military deferment and Homestead Exemption help certain groups * Cuyahoga County hosts sessions to teach about the reappraisal process and tax help

By using these tax benefits, homeowners in Cuyahoga County can save a lot. It’s important to remember that property taxes help fund important services. These include schools, infrastructure, libraries, and public safety.

| Program | Benefit | Eligibility |

|---|---|---|

| Owner Occupancy Credit | Reduction in real estate taxes | Homeowners who use the property as their principal place of residence |

| Homestead Exemption | Reduction in real estate taxes | Senior citizens, permanently disabled individuals, and surviving spouses of public service officers killed in the line of duty |

Commercial Property Search Methods

Looking for commercial property records in Cuyahoga County? You need the right tools and methods. You can search by address, owner name, or parcel number. This makes it easy to find business property records and investment property info.

The Cuyahoga County Auditor’s Office and Recorder’s Office have online tools for this search. Their databases and search engines help you find property values, tax info, and who owns it.

Accessing Business Property Records

The Cuyahoga County Auditor’s Office website is where you can find business property records. It has a simple search tool. You can look up properties by address, owner name, or parcel number. You’ll also get info on property values, taxes, and more.

Investment Property Information

For investment property info, check out the Cuyahoga County Recorder’s Office database. It has historical records like property deeds and mortgages. This info helps investors learn about property ownership, values, and sales history.

Some important stats to know about Cuyahoga County’s commercial property records include:

- Over 550,000 active parcels in the database

- Commercial property values have gone up 8.45%

- 945,623 property searches have been made

- 1,287,459 parcels have been queried

Using these resources, you can do a detailed commercial property search. You’ll get access to important business and investment property info in Cuyahoga County.

Real Property Transfer and Documentation

Understanding the real property transfer process in Cuyahoga County is key. It involves moving ownership from one person to another. This process comes with taxes and fees. The county’s property records are important, showing who owns the property and past sales.

Documents like deeds, titles, and affidavits are needed for the transfer. The deed type depends on the situation, with Warranty and Quitclaim Deeds common. You also have to pay a conveyance fee, $1.00 for every $1,000 of the property’s value.

Some important parts of the transfer process in Cuyahoga County include:

- Transfer tax: A tax based on the sale price, with a rate that’s a percentage of the sale price.

- Conveyance fee: A fee of $1.00 for every $1,000 of the property’s value, based on its assessed value.

- Recording fees: Fees for filing the deed with the Cuyahoga County Recorder’s Office, which vary based on the document and the number of pages.

- Electronic recording options: Title companies and lawyers have access to the electronic system, which provides faster document processing and time-saving benefits.

It’s vital to make sure all documents are correct and filed on time. The Cuyahoga County Auditor’s website has a tool for searching properties. It helps find information by ID, address, or owner name.

It also offers court records, deed transfers, and online document filing. Knowing the transfer process and what documents are needed helps ensure a smooth transfer.

Property Valuation and Assessment Records

Knowing about property valuation and assessment records is key for property owners in Cuyahoga County. The Cuyahoga County Auditor’s office handles these tasks.

They give info on how to appeal property valuations. Property valuation sets the value of a property, which affects property taxes.

Important parts of property valuation and assessment records include understanding property values, assessment cycles, and appeal procedures.

In Cuyahoga County, property values are checked every three years and updated every six years.

The average value increase in 2024 was 32.22% for homes, 8.45% for businesses, and 8.49% for industrial properties.

Property Values

The Cuyahoga County Auditor’s office sets property values. They look at location, size, and condition. Property owners can see their valuation and assessment records online or by contacting the office.

Assessment Cycles

Ohio reassesses property values every three years and reappraises them every six years. This keeps values current and reflects market changes. The Cuyahoga County Auditor’s office explains how these cycles affect property taxes.

Appeal Procedures

If property owners disagree with their valuation, they can appeal. They can do an Informal Review Complaint or a Formal Complaint with the Board of Revision.

The deadline for an Informal Review Complaint was August 30, 2024. The deadline for a Formal Complaint is between January 1, 2025, and March 31, 2025.

Here is a summary of the key dates and procedures for appealing property valuations:

- Informal Review Complaint: August 30, 2024

- Formal Complaint: January 1, 2025 – March 31, 2025

Understanding property valuation, assessment records, and appeal procedures is vital for property owners in Cuyahoga County. By staying informed, property owners can ensure they’re paying fair property taxes. They can also use exemptions and credits available to them.

Conclusion: Maximizing Your Property Record Search Success

When searching for property records in Cuyahoga County, a few tips can help you succeed. Start by using the online tools and databases from the county auditor and recorder’s offices. These platforms make it easy to find property details, who owns it, and tax information.

If you need help or have questions, don’t be shy to reach out. The offices are there to assist you. They can help you understand the property records better. Similarly if you want to search property ownership records in Stark county, you can use Stark county auditor Property Ownership Records tool for correct records.

It’s also smart to keep up with any changes in property ownership, taxes, or value. The county auditor’s office updates this information often. They also send alerts about unpaid taxes or foreclosures.

By staying informed, you can make better decisions. You might even find tax credits or exemptions you can use. Remember, being thorough and patient is key. The more effort you put in, the better your results will be.