Homeowners in Cuyahoga County, Ohio, deal with some of the highest property taxes in the state. The average effective tax rate is 2.51%, making Cuyahoga County a leader in property tax burdens. Luckily, the Cuyahoga County Fiscal Office offers a tax estimator tool. This tool helps residents quickly figure out their annual property tax.

Ohio’s average property tax rate is 1.41%, which is higher than the national average. But, property tax rates vary a lot across different counties in Ohio.

For example, Lawrence County has a much lower rate of 0.86%, showing big differences in property taxes across the state.

Using the Cuyahoga County tax estimator, homeowners can understand their tax liability better and plan their finances.

Property Tax Calculator

Note: If the calculator is not working, it could be a temporary error. Please try again in 30 minutes.

Property Taxes in Cuyahoga County

Property taxes in Cuyahoga County, Ohio, are complex. They involve the state’s tax system, local government needs, and property assessments.

To understand the Cuyahoga County property tax rate, knowing Ohio’s property tax structure is key. The region’s high tax burden is due to unique factors.

Overview of Ohio’s Property Tax System

Ohio’s property tax system uses a six-year appraisal cycle. Values are calculated at 35% of a property’s appraised market value. This ratio affects how much homeowners pay in taxes.

Why Cuyahoga County Has the Highest Rates

Cuyahoga County, with Cleveland as its city, has high property tax rates. The county’s large population and extensive infrastructure are reasons. Local governments and schools use property tax revenue for essential services and improvements.

Basic Tax Calculation Principles

Property taxes in Cuyahoga County are based on a millage rate. One mill is $1 of tax for every $1,000 in assessed value. The median annual property tax is $3,460 for a home worth $137,800, showing the high tax burden.

| Metric | Value |

|---|---|

| Median Home Value in Cuyahoga County | $137,800 |

| Median Annual Property Tax | $3,460 |

| Effective Tax Rate | 12.26 mills |

| Approved Tax Rate | 14.85 mills |

The Cuyahoga County Tax Estimator Tool

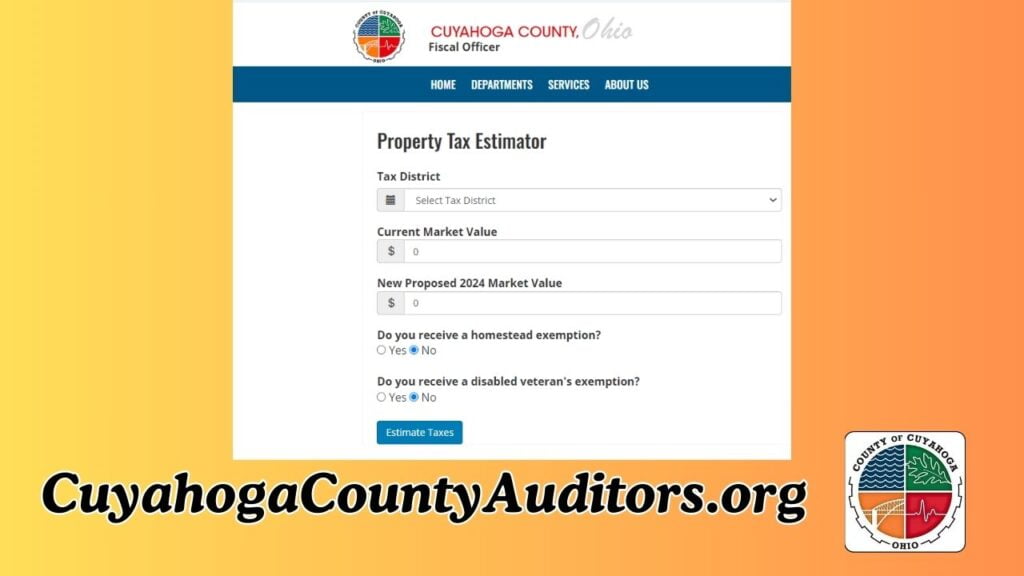

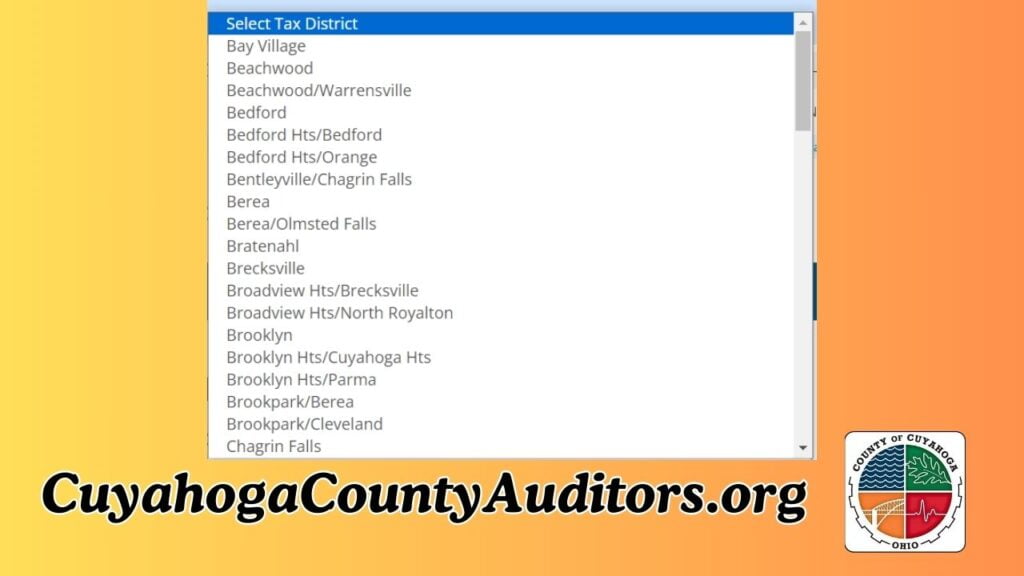

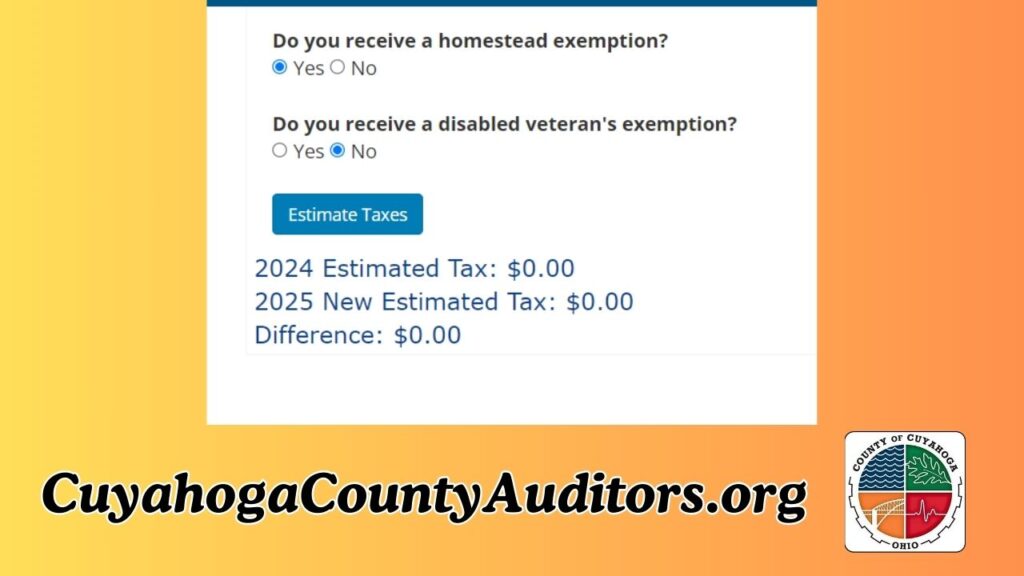

The Cuyahoga County Fiscal Office has a great online tool for homeowners. It helps them figure out their property taxes. The tool looks at tax rates, exemptions, and credits to give a clear estimate.

Homeowners can use this tool to understand their tax burden better. They can enter their property details and get a breakdown of their estimated taxes right away. It’s easy to use and gives accurate information.

This tool offers detailed insights for each neighborhood. It shows how school districts and local taxes affect your taxes. This helps homeowners make smart choices about their properties and budgets.

The tool is also a learning tool. It helps people understand the property tax system. It explains important terms like assessment ratios and tax rates. This knowledge can help homeowners find ways to lower their taxes.

In a county with high property taxes, this tool is very helpful. It gives homeowners clear, personal tax info. This helps them make better financial decisions and understand their taxes better.

Property Tax Rates Comparison in Ohio Counties

Cuyahoga County in Ohio has the highest property tax rates in the state. Its rate is a high 2.51%, much higher than the state’s average of 1.36%. Other high Ohio county tax rates are found in Montgomery (2.29%), Franklin (2.06%), Lucas (2.03%), and Hamilton (1.96%).

Understanding Effective Tax Rates

The effective tax rates show how much property taxes are as a percentage of home value. These rates vary due to local government actions, home values, and services offered. This makes the property tax comparison in Ohio quite different.

Regional Tax Rate Variations

In the Greater Cleveland/Akron area, property tax rates vary a lot. Cuyahoga Heights has a lower rate of 1.73%, much less than the national average of 0.99%. Yet, Cuyahoga County has some of the highest effective tax rates in the state.

How Property Values Affect Your Tax Bill

Property values are key in figuring out your tax bill in Cuyahoga County. When property values go up, so do the taxes. For instance, a $150,000 home in the county would pay about $3,765 in property taxes each year.

The recent reappraisal has led to a 32.22% jump in home values across the county. This big increase in home values will make property tax bills go up.

In Ohio, the tax value is 35% of the appraised value. So, a $100,000 property would be taxed at $35,000. As home values keep going up, so will your tax bills.

| Location | Property Value Increase | Impact on Tax Bill |

|---|---|---|

| Cleveland | 49% average increase | Significant tax bill increase |

| East Cleveland (impoverished suburb) | 67% average increase | Substantial tax bill increase |

| Hunting Valley | 15% increase | Moderate tax bill increase |

The rise in property values has a big effect on tax bills in Cuyahoga County. Homeowners in Cuyahoga County should get ready for higher property tax bills. This is because of the recent reappraisal and the county’s increasing home values.

Recent Property Value Changes and Their Impact

Cuyahoga County has seen big jumps in property values. On average, homes have gone up by 32%. Some areas have seen even bigger increases.

2024 Reappraisal Results

The reappraisal, done every six years, shows big differences. Hunting Valley saw a 15% increase. But East Cleveland and Maple Heights saw values jump by 67% and 59%, respectively.

These changes mean big tax hikes for some. For example, a $100,000 home in Cleveland could see a $9.60 tax increase. A $180,000 home could see a $630 tax hike.

Neighborhood-Specific Value Changes

- East Cleveland: 67.38% increase

- Maple Heights: 59% increase

- Cleveland: 49% average increase

- Hunting Valley: 14.95% increase

Homeowners can use the county’s online tax calculator to see how these changes will affect their taxes. The deadline to file informal complaints is August 30th, 2024. Formal complaints can be filed from January 1st to March 31st, 2025.

| Property Location | Old Value | New Value | Tax Increase |

|---|---|---|---|

| Cleveland | $100,000 | $128,000 | $9.60 |

| Cleveland | $180,000 | $260,000 | $630.00 |

Understanding the Six-Year Appraisal Cycle

Ohio’s property tax system has a six-year cycle. County auditors check property values every six years. This keeps taxes fair for homeowners and businesses.

In Cuyahoga County, homes saw a 32.22% value increase on average. Commercial and industrial properties saw smaller increases of 8.45% and 8.49%, respectively. But, Ohio’s tax rules, like House Bill 920 (HB 920), help keep taxes stable.

Ohio’s property taxes are based on mills. One mill costs $1.00 for every $1,000 of value each year. There are two types of taxes: inside and outside millage. Knowing this helps property owners understand their taxes better.

Cuyahoga County offers tax breaks for homeowners. The Homestead Exemption helps those who meet certain criteria. The Owner-Occupancy Credit gives a 2.5% tax cut for those who live in their homes.

As the 2024 reappraisal cycle starts, Cuyahoga County property owners can file complaints. They can do this between July 1 and August 30, 2024. If not happy with the result, they can appeal to the Board of Revision by January 1 to March 31, 2025.

Calculating Your Property Tax in Cuyahoga County

Knowing how to figure out your property tax in Cuyahoga County is key for managing your money. It helps you plan for the future. You need to find your property’s assessed value and then use the right tax rate.

Step-by-Step Estimation Process

To guess your property tax, just follow these steps:

- First, find your property’s assessed value. It’s 35% of its appraised market value.

- Then, multiply the assessed value by the tax rate in mills. Remember, one mill is $1 for every $1,000 of assessed value.

- After that, the number you get is your estimated property tax.

Understanding Tax Assessment Ratios

The tax assessment ratio is very important for figuring out your property tax in Cuyahoga County. This ratio shows what percent of your property’s fair market value is used for the assessed value. Knowing this ratio helps you guess your property tax better and plan ahead.

The Cuyahoga County Cuyahoga property tax calculator makes this easier. It gives you accurate estimates based on current rates and data. This tool helps you property tax estimation and plan your tax budget better.

Property Tax Relief Programs and Exemptions

Cuyahoga County has tax relief programs and exemptions for property owners. The Homestead Exemption helps seniors, veterans, and people with disabilities. It lets them exclude part of their property’s value from taxes, lowering their tax bill.

To get the Homestead Exemption, your household income must be under $38,600 in 2023 or $36,100 in 2022. You must apply by December 31st of the year you’re applying. The application period is from January 1st to December 31st.

Cuyahoga County also helps homeowners who are struggling financially or have storm-damaged properties. Homeowners can apply for a lower property value assessment. This can help reduce their Cuyahoga County tax relief burden.

Special assessments like water and sewer charges, trash and recycling fees, and street maintenance fees can also affect your taxes. These can add to the property tax exemptions homeowners in Cuyahoga County face.

For more details on homeowner assistance programs and how to apply, call the Cuyahoga County Department of Assessment and Taxation at 216-443-7050, Prompt 1. You can also email them at homestead@cuyahogacounty.us.

Important Deadlines for Property Tax Payments

In Cuyahoga County, property taxes are paid in two parts. The first part is due in mid-February, and the second in mid-July. Homeowners can use the EasyPay system. It lets them pay monthly, semiannually, or yearly to manage their taxes and avoid late fees.

Payment Schedules

Important dates for property tax payments in Cuyahoga County include:

- February 15th: First half of real estate taxes due

- July 18th: Second half of real estate taxes due

- July 31st: Second half of manufactured home taxes due

Late Payment Penalties

In Ohio, property taxes are due by December 31st and June 20th. Late penalties are 10% for overdue taxes. Homeowners can get help from the Property Tax Assistance program. It offers up to $10,000 for those aged 70 or older with income under $70,000 to prevent foreclosure.

Delinquent property tax payments in Ohio face a 10% penalty. This can be reduced to 5% if paid within 10 days after the due date. Interest is added twice a year: on the first day of the month after the second half’s due date and on December 21.

| County | Effective Tax Rate |

|---|---|

| Franklin County | 2.06% |

| Cuyahoga County | 2.51% |

| Hamilton County | 1.96% |

| Lawrence County | 0.86% |

Appealing Your Property Tax Assessment

If you own a home in Cuyahoga County, you can challenge your property’s tax assessment. You might think the value is off. The appeal process has steps you need to follow to make your case.

The first step is to file a complaint by August 30, 2024. You’ll need to collect evidence like appraisal reports and photos. This evidence should show your property’s real market value. By November, you’ll hear back from the Board of Revision.

If you’re not happy with the Board’s decision, you can appeal again. You have from January 1, 2025, to March 31, 2025, to do this. Your case will be reviewed by the Cuyahoga County Board of Tax Appeals. You can even appeal to the Court of Common Pleas, but that costs $250.

Remember, the appeal process has strict deadlines. If you miss them, your appeal might be thrown out. You must file your appeal with the Board of Revision, the Court of Common Pleas, and the Cuyahoga County Fiscal Officer within 30 days.

Thinking about appealing your property tax? Call the Cuyahoga County Appraisal Office at (216) 443-7420 ext. 3. Or, go to one of the Fiscal Officer’s information sessions. There, you can learn more about the process and your rights.

Tax Rate Differences Across Cuyahoga County Cities

Cuyahoga County has many different cities, each with its own tax rates. Ohio’s property tax system is the same everywhere, but rates can change a lot in each city. This is because of the unique needs and budgets of each area.

Municipal Tax Variations

Many things affect property taxes in Cuyahoga County cities. These include the services offered, the state of the roads, and the local government’s finances. For example, some cities might charge more for better police services or roads. Others might keep taxes low to attract people and businesses.

The tax rates in Cuyahoga County cities can be as low as 5% or as high as 12% of a property’s value. For a $200,000 home, this means taxes could be anywhere from $10,000 to $24,000 a year. This depends on the city.

School District Impact on Rates

Property owners in Cuyahoga County also face taxes from school districts. These taxes can add a lot to what you pay. School districts have different needs and budgets, affecting how much they tax.

Some districts might tax more to support better schools and programs. Others might keep taxes lower. This means people in one city could pay much more in school taxes than those in another, even if the city taxes are similar.

| City | Municipal Tax Rate | School District Tax Rate | Total Property Tax Rate |

|---|---|---|---|

| Cleveland | 7% | 9% | 16% |

| Shaker Heights | 5% | 12% | 17% |

| Lakewood | 8% | 11% | 19% |

| Parma | 6% | 10% | 16% |

Historical Property Tax Trends in Cuyahoga County

Cuyahoga County, Ohio, is known for its high property taxes. It ranks high in the state. This is because of the need for funding public services and infrastructure in the urban area.

Over the last decade, property tax assessments in Cuyahoga County have gone up. In 2015, the average assessment was $145,000. By 2019, it had risen to $170,000, a 17.2% increase. The county’s property values have increased by an average of 32% in the latest reappraisal cycle.

The changes in property values have affected Cuyahoga County’s school districts. The increases ranged from $144,746 for Cuyahoga Heights to $5,839,432 for Cleveland. The total increase for all districts is $39,498,165.

The high property tax rates in Cuyahoga County are due to its reliance on property taxes. This has made residents and businesses aware of the need for fair tax policies. They want policies that balance revenue needs with taxpayer burdens.

As the county prepares for its next property reappraisal in 2024, everyone will watch the property tax trends closely. They will look for a balance between the need for revenue and the taxpayer burden.

Understanding Your Tax Bill Components

It’s important to know what makes up your Cuyahoga County tax bill. Your property tax includes the assessed value, tax rates, exemptions, and the total amount you owe. These details are key to understanding your tax liability.

The assessed value of your property is a big factor in your taxes. In Ohio, properties are assessed at 35% of their market value. For example, if your home is worth $200,000, its assessed value for taxes is $70,000.

The tax rates on your property’s value depend on where you live and local taxes. These taxes include school, municipal, and county levies. They all add up to your property tax rate. If your any relative or friend live in any other county like Stark county, he can use Stark County Auditor Tax Estimator to understand his tax bill components.

If you’re a homeowner in a nearby county, understanding how local tax structures compare can be helpful. You can check out the Trumbull County property tax breakdown or the Stark County property tax overview to see how rates and exemptions differ across counties.

- Knowing your tax rates can help you find ways to save on taxes.

- Exemptions, like the homestead exemption for owner-occupied homes, can lower what you owe.

By looking closely at your tax bill, you can make sure it’s right. You can also find ways to save on taxes. This is useful for appealing your property’s value or finding tax relief in Cuyahoga County.

Conclusion

Understanding Cuyahoga County’s property tax system is key for homeowners. It helps them manage their taxes better. The county’s high tax rates and recent changes highlight the need to stay informed.

The Cuyahoga County Tax Estimator tool is a great resource. It helps homeowners calculate their taxes and find relief programs. Knowing important deadlines, like appeal filing periods and Homestead Exemption applications, helps them navigate the system.

Mastering Cuyahoga County’s property taxes helps homeowners make smart decisions. It lets them plan their budgets and use tax planning strategies. Keeping up with property value trends and tax rate changes across the area is essential. It helps homeowners maximize their property ownership in Cuyahoga County.