Understanding your home’s value in Cuyahoga County is key, whether you’re buying, selling, or planning for taxes. Property valuation here is complex, using various methods to estimate a property’s worth.

This assessment affects your property taxes and is vital for home ownership decisions.

This article will explore the main property valuation methods in Cuyahoga County. We’ll explain how they work and how you can use this info to understand or challenge your property’s value.

How is Property Value Determined in Cuyahoga County?

Cuyahoga County, like Ohio, has a structured process for assessing property values. The main methods include the Sales Comparison Approach, the Cost Approach, and the Income Approach.

Each method has its purpose and is applied differently based on the property type. Knowing these methods helps you understand how property values are calculated.

1. Sales Comparison Approach

The Sales Comparison Approach is the most used for homes. It compares your property to similar ones that have recently sold nearby. This method is based on the idea that no one pays more for a property than it would cost to buy a similar one.

Key Factors Considered in the Sales Comparison Approach:

- Location: The area around your property greatly affects its value. Things like schools, parks, and shopping centers matter.

- Size: The size of your property, including the house and land, is a big factor in its value.

- Condition: The condition of your home, including any upgrades, impacts its value. Well-kept homes are worth more.

- Age: Older homes might have lower values due to wear and tear, unless they’ve been updated or have historic significance.

- Amenities: Features like pools, finished basements, and energy-efficient appliances can increase your home’s value.

Example:

For a three-bedroom house with a finished basement, assessors compare it to similar homes in your area. They adjust for any differences in size, condition, or features.

Limitations:

- Availability of Comparables: In rural or less developed areas, finding similar properties for comparison can be hard.

- Market Fluctuations: This method relies on the current market, which can change, affecting property values.

2. Cost Approach

The Cost Approach is used for newer, unique, or hard-to-compare properties. It calculates the cost to replace the property with a similar one, then subtracts depreciation.

Assessors look at the cost to build a new home and adjust for the property’s age and condition.

Key Elements in the Cost Approach:

- Replacement Cost: The cost to rebuild the property with current materials and methods. This includes labor, materials, and permits.

- Depreciation: Buildings lose value over time due to wear and tear. Depreciation is subtracted from the replacement cost to account for the property’s age and condition.

- Land Value: The land value is added to the replacement cost. This reflects that land does not depreciate like buildings do.

Property Valuation Methods

If your home is new, rebuilding it might cost a lot, but there’s little depreciation to subtract. For older homes, depreciation is key in the assessment.

Limitations:

- Not Ideal for Older Properties: The Cost Approach is less reliable for older homes. This is because building codes, materials, and labor have changed.

- Land Value Overemphasis: Large plots of land can make the land’s value too high. This can affect the total property assessment, even if the structure is not as valuable.

3. Income Approach

The Income Approach is for commercial and rental properties. It values a property by its income. The more income, the higher the value.

Key Factors Considered in the Income Approach:

- Potential Rental Income: The income from renting out the property.

- Operating Expenses: Costs like property management fees, maintenance, utilities, and taxes that reduce income.

- Capitalization Rate: The return on investment based on income. It’s used to estimate the property’s value.

Example:

For an apartment complex, the Income Approach looks at rent collected and subtracts expenses. The remaining income is capitalized to find the property’s value.

Limitations:

- Market Uncertainty: This method relies on income projections, which can be unpredictable due to market changes or tenant turnover.

- Complex Calculations: Applying the Income Approach to residential properties not rented out can be tricky.

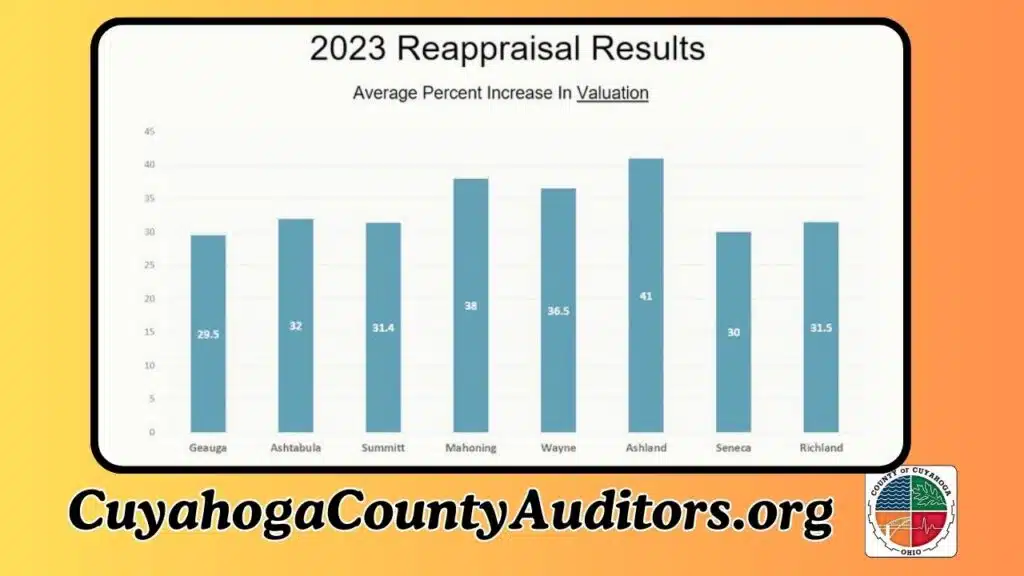

The Reappraisal Process in Cuyahoga County

In Cuyahoga County, properties are reappraised every six years. This ensures values reflect current market conditions and property values.

Importance of the Reappraisal Process:

- Ensures Fairness: Regular updates prevent unfair taxes based on outdated values.

- Adjusts for Market Changes: Reappraisal keeps the county in line with value changes, avoiding tax inequalities.

- Informs Taxation: Updated assessments are used for property taxes for the next six years, vital for homeowners and local government.

Assessors consider many factors during reappraisal. They might use all three valuation methods, depending on the property type.

Cuyahoga County Property Tax Rates and Assessed Values

| YearAverage Property Value Increase (%)Commercial Property Value Increase (%)Residential Property Tax Rate (%)Commercial Property Tax Rate (%) | ||||

|---|---|---|---|---|

| 2023 | 3.5% | 1.2% | 2.4% | 2.5% |

| 2024 | 6.1% | 2.8% | 2.6% | 2.7% |

| 2025 | 5.4% | 4.0% | 2.5% | 2.9% |

How Property Valuation Impacts Property Taxes

Property taxes in Ohio are based on the property’s assessed value. The formula to calculate property taxes is:

Property Tax=Assessed Value×Tax Rate

Assessed Value:

- The Assessed Value is usually 35% of the property’s market value. This is determined by the county assessor.

- Property tax rates change based on where you live in Cuyahoga County. These rates are applied to the assessed value to figure out your tax bill.

Even if tax rates don’t change, property values can go up or down. This could make your property taxes go up, even if the tax rate stays the same.

How the Reappraisal Affects Tax Bills:

If your property value goes up during reappraisal, you might see a higher tax bill. But, the tax rate might also change. This could help keep your tax bill from going up too much.

How to Appeal Property Valuation in Cuyahoga County

If you don’t agree with your property’s assessed value, you can appeal. Here’s how to appeal in Cuyahoga County:

- File a Complaint: You can file a complaint with the Cuyahoga County Board of Revision within 30 days of getting your assessment notice.

- Submit Evidence: Show evidence to support your case. This could be comparable sales data, independent appraisals, or proof of property damage or defects.

- Attend a Hearing: Present your evidence to the Board of Revision. A panel will review your case.

- Further Appeals: If you’re not happy with the decision, you can appeal further. You can take your case to the Ohio Board of Tax Appeals or the Court of Common Pleas.

Key Dates for Property Valuation and Appeals in Cuyahoga County

| Year | Property Reappraisal Date | Appeal Filing Deadline | Hearing Schedule |

|---|---|---|---|

| 2024 | January 1st | March 31st | April – June |

| 2025 | January 1st | March 31st | April – June |

| 2026 | January 1st | March 31st | April – June |

Conclusion

Property valuation in Cuyahoga County is key for figuring out property taxes and values. It’s important for homeowners, buyers, and sellers to understand how their home’s value is assessed. Knowing the valuation methods and how to appeal can help you make smart decisions and manage your property well.

Regular reappraisals, fair assessments, and the right tools help ensure property owners in Cuyahoga County are taxed fairly based on their property’s true value.