The Cuyahoga County Transfer Recording division is key in handling property transfers. They make sure all deals are recorded right and follow Ohio laws.

This office is the main place for tracking who owns what in the county, including land and mineral rights.

Knowing how property transfers work in Cuyahoga County is important for a smooth deal. The Recorder’s Office handles all the county’s real estate needs.

They require a DTE 100 Form for every property change, so it’s good to know the rules.

Property Transfers in Cuyahoga County

Property transfers in Cuyahoga County involve documenting and registering real estate deals. These must follow legal rules and fees, like cuyahoga county recording fees.

The cuyahoga county recorder’s office ensures all deals are recorded correctly and meet the needed standards.

The process of moving property in Cuyahoga County is complex. It includes different types of transfers, like survivorship tenancy and joint and survivorship property.

Knowing the various types and legal needs is key, including cuyahoga county real estate transfers fees.

What Constitutes a Property Transfer

A property transfer happens when ownership changes hands. It’s vital to follow all legal steps, including paying cuyahoga county recording fees. This can be due to a sale, a will, or a trust.

Types of Property Transfers

In Cuyahoga County, there are several types of property transfers. These include:

- Survivorship tenancy

- Joint and survivorship property

- Transfer on death

- Warranty deeds

Legal Requirements Overview

The cuyahoga county recorder’s office needs all property transfers to be documented and recorded. This includes filing a deed, which must be signed and notarized. Also, all fees, like cuyahoga county real estate transfers fees, must be paid.

The Role of the Cuyahoga County Recorder’s Office

The Cuyahoga County Recorder’s Office is key in the property transfer process. They collect fees, check if documents are legal, and share info with the public. They keep records of property transactions from 1810, making sure everything is legal and accurate.

The recorder’s office handles the cuyahoga county conveyance form, a vital document in property transfers. They also tell you about the fees, like the primary and local conveyance fees.

Some important tasks of the Cuyahoga County Recorder’s Office include:

- Collecting fees for property transfers

- Reviewing documents for legal compliance

- Providing information to the public on property transfers

- Processing the cuyahoga county conveyance form

The Cuyahoga County Recorder’s Office is vital in the property transfer process. Knowing their role helps make property transfers smooth and efficient.

Essential Documents for Transfer Recording

When you’re transferring property in Cuyahoga County, you need to get the right documents ready. The recorder of deeds in Cuyahoga County asks for specific papers, like deeds and conveyance forms. It’s also important to know the fees for these documents.

A quit claim deed in Cuyahoga County is often used for property transfers. To make the transfer go smoothly, all documents must be correct, and the fees must be paid. The fees include a conveyance fee, which is 0.04% of the purchase price or $4.00 for every $1000, whichever is more.

Deed Requirements

A deed is key in property transfers. It must follow Ohio’s laws. The deed should list the grantor’s and grantee’s names, describe the property, and have the grantor’s signature.

Conveyance Forms

Conveyance forms are also important. They give details about the transfer, like the price and property description. The recorder of deeds in Cuyahoga County needs these forms to be filled out right and with the right fees.

Supporting Documentation

For property transfers, you might need supporting documents like the DTE 100 form. This form helps figure out the conveyance fee. Make sure all supporting documents are correct and complete to avoid delays.

Complete Guide to Cuyahoga County Transfer Recording Fees

The cuyahoga county ohio recorder office has a detailed guide on transfer recording fees. It’s important to know the fees when recording a transfer in Cuyahoga County. The county charges a transfer fee and a conveyance fee, with specific rates and calculations.

The basic recording fees are $28.00 for the first two pages and $8.00 for each extra page. There are also fees for separate releases, partial releases, or assignments.

These fees are $28.00 for the first two pages and $8.00 for each extra page. A non-conforming fee of $20.00 is charged for documents that don’t meet requirements.

| Fee Type | Fee Amount |

|---|---|

| Basic Recording Fee (first 2 pages) | $28.00 |

| Basic Recording Fee (each additional page) | $8.00 |

| Separate Release, Partial Release, or Assignment Fee (first 2 pages) | $28.00 |

| Separate Release, Partial Release, or Assignment Fee (each additional page) | $8.00 |

| Non-Conforming Fee | $20.00 |

The cuyahoga county recorder office only accepts cash, certified check, or money order for payments. It’s important to remember that personal checks are not accepted. Knowing the fee structure and costs is key when working with the cuyahoga county ohio recorder office.

DTE 100 Form

The DTE 100 form is key in the Cuyahoga County transfer recording process. It’s handled by the cuyahoga county records office. Knowing the filing needs, common errors, and who gets a break is vital.

The cuyahoga county fiscal office checks these documents to make sure everything is right.

It’s important to fill out the DTE 100 form right and on time. If you don’t, you might face penalties. The form has parts like the value statement and why you might not have to pay a fee.

The cuyahoga county auditor looks at these to figure out the fee and if the transfer is recorded correctly.

Filing Requirements

To file the DTE 100 form, you need to provide:

- Property description and location

- Purchase price and consideration

- Exemption status, if applicable

- Signature of the grantor and grantee

Make sure all details are correct and complete. This helps avoid delays or having your transfer rejected.

Common Mistakes to Avoid

When filing the DTE 100 form, avoid these mistakes:

- Incomplete or inaccurate information

- Failure to sign the form

- Not submitting the required supporting documentation

These errors can cause delays or penalties. So, double-check the form before you send it in.

Exemption Criteria

The DTE 100 form has rules for who might not have to pay a fee. The cuyahoga county auditor checks these rules. Here are the exemptions:

| Exemption Category | Description |

|---|---|

| (a) Governmental agency transfer | Transfer between governmental agencies |

| (b) Gift between spouses or parents to children | Transfer as a gift between spouses or parents to children |

| (c) Charitable transfer | Transfer to a charitable organization |

These exemptions can lower or wipe out the fee. So, it’s important to check if you qualify.

Quit Claim Deeds in Cuyahoga County

Quit claim deeds are key in cuyahoga county property transfers 2025. They help transfer property ownership in Cuyahoga County. It’s important to know their purpose and what’s needed.

In for sale by owner cuyahoga county deals, quit claim deeds are handy. But, make sure all documents are correct. This includes the deed to avoid problems or delays.

- Ensure the deed is properly drafted and executed to avoid any possible disputes or issues.

- Verify that all necessary documentation, including the deed, is recorded with the Cuyahoga County Recorder’s Office.

- Be aware of the State Real Estate Transfer Tax and County Transfer Tax, which are $1 per $1,000 of sale price and $0.50 per $1,000 of sale price, respectively.

Understanding quit claim deeds in cuyahoga county property transfers 2025 is key. Following the right steps ensures a smooth property transfer.

| Fee Type | Amount |

|---|---|

| Recording Fee (first page) | $28 |

| Recording Fee (each additional page) | $8 |

| State Real Estate Transfer Tax | $1 per $1,000 of sale price |

| County Transfer Tax | $0.50 per $1,000 of sale price |

Property Transfer Tax Considerations

When you move property in Cuyahoga County, think about the taxes involved. The ohio transfer tax, which includes state and county taxes, can raise the cost of the transfer. For example, the county tax is $0.50 for every $1,000 of sale price.

The state of Ohio also charges a transfer tax of $1 for every $1,000 of sale price. Taxes in Lorain County might differ, but in Cuyahoga County, the total tax can be quite high. Here’s a look at the estimated 2025 transfer tax:

| Tax Type | Rate | Amount |

|---|---|---|

| State Transfer Tax | $1 per $1,000 | $2,000.00 |

| County/Other Transfer Tax | $0.50 per $1,000 | $1,250.00 |

| Mortgage Tax | Varies | $5,625.00 |

| Total Estimated 2025 Transfer Tax | $8,875.00 |

Knowing about these taxes can help you plan for your property transfer in Cuyahoga County.

Digital Recording Options and Online Services

Cuyahoga County offers digital recording options and online services. This makes it easier for residents to manage their property records. The deeds office has an online platform for recording documents, including the cuyahoga county quit claim deed form.

The cuyahoga county dte 100 form is also online. This lets residents easily access and submit documents. With e-recording platforms, you can submit documents online, saving trips to the recorder’s office.

E-Recording Platforms

Cuyahoga County uses CSC eRecording services, one of 67 Ohio counties. This platform is secure and efficient for recording documents. About 83.58% of Ohio counties are now part of the CSC eRecording network.

Document Submission Guidelines

To submit documents online, follow these steps:

- Visit the Cuyahoga County Recorder’s website

- Create an account or log in to an existing one

- Select the type of document to be recorded

- Upload the required documents and pay the applicable fees

By following these guidelines, residents can easily submit documents online. This makes recording property documents more efficient and convenient.

| County | eRecording Services |

|---|---|

| Cuyahoga County | CSC eRecording |

| Franklin County | CSC eRecording |

| Hamilton County | CSC eRecording |

The Conveyance Process Timeline

The conveyance process in Cuyahoga County has a specific timeline. It includes steps and deadlines to follow. Knowing this timeline helps individuals plan and manage their time well.

The process starts with preparing the needed documents, like the cuyahoga county exempt conveyance form and cuyahoga county deed records.

Another important part is the cuyahoga county transfer and recording. This step involves sending the documents to the county recorder’s office and paying fees. It’s vital to make sure all documents are correct and complete to avoid delays.

Here are the general steps involved in the conveyance process:

- Prepare the necessary documents, including the deed and conveyance form

- Submit the documents to the county recorder’s office

- Pay the applicable fees, including the transfer and recording fees

- Wait for the documents to be processed and recorded

By following these steps and understanding the conveyance process timeline, individuals can ensure a smooth and efficient transfer of property in Cuyahoga County.

| Step | Description | Deadline |

|---|---|---|

| 1. Prepare documents | Prepare the necessary documents, including the deed and conveyance form | Varies |

| 2. Submit documents | Submit the documents to the county recorder’s office | Within 30 days of preparation |

| 3. Pay fees | Pay the applicable fees, including the transfer and recording fees | At the time of submission |

Special Considerations for Commercial Properties

Commercial properties in Cuyahoga County need special attention during the transfer process. The cuyahoga county records office ensures all documents are recorded correctly.

It’s important to follow the rules set by the cuyahoga county fiscal office recorded documents and the cuyahoga county auditor.

The steps to transfer commercial properties include preparing and submitting certain documents. The cuyahoga county auditor’s office helps with the needed documents and steps. Important things to consider include:

- Additional requirements for commercial properties, such as environmental assessments and zoning approvals

- Business entity transfers, including the transfer of ownership to a Limited Liability Company (LLC)

- Compliance with Ohio Revised Code sections, including 315.251, 317.22, and 319.203

Working with a licensed attorney or a licensed professional surveyor is key. They help make sure all documents are right. The cuyahoga county fiscal office recorded documents and the cuyahoga county auditor’s office offer help and guidance during the process.

For Sale By Owner Transfer Requirements

When you’re selling your property in Cuyahoga County on your own, knowing the rules is key. You’ll need to deal with the cuyahoga county property record charge and cuyahoga county deeds. You might also need a cuyahoga county quit claim deed to transfer the ownership.

To make the transfer go smoothly, follow these steps:

- Get all the needed documents, like the deed and any other required papers.

- Check the cuyahoga county property record charge to know the fees you’ll pay.

- Prepare the cuyahoga county quit claim deed if you need it to transfer the ownership.

Remember, there are legal things to think about too. You must record the cuyahoga county deeds and property record charge correctly. This way, you can avoid any problems. By knowing what to do, you can handle the for sale by owner transfer in Cuyahoga County well.

Common Transfer Recording Challenges

When dealing with cuyahoga county real estate transfers, many face challenges. Ensuring all documents are correct is key. Any mistakes can cause delays or even stop the transfer. The cuyahoga county recorder’s office has clear rules for documents like deeds and conveyance forms.

Understanding the fees for recording transfers is another hurdle. These costs can add up quickly. It’s important to include them in your budget. Also, following the law is critical. Not doing so can lead to fines and lawsuits.

Some common problems during the process include:

- Incorrect or incomplete documentation

- Insufficient fees or incorrect payment

- Failure to meet legal requirements, such as recording deadlines

To tackle these issues, working closely with the cuyahoga county recorder’s office is vital. Make sure all documents are right and complete. Getting help from a professional, like a title company, can also be beneficial. They can guide you through the complex process and help ensure a smooth transfer.

| Challenge | Solution |

|---|---|

| Incorrect documentation | Verify all documents with the cuyahoga county recorder’s office |

| Insufficient fees | Check the cuyahoga county transfer recording fees and ensure correct payment |

| Legal compliance issues | Seek professional advice to ensure all legal requirements are met |

Working with Title Companies

When you’re dealing with property transfers in Cuyahoga County, title companies are key. They handle title searches, escrow, and document prep. Their help ensures a smooth process, guiding you through fees and understanding the recorder’s role.

These companies offer essential services for a successful transfer. Here are some key ones:

- They review and prepare the cuyahoga county conveyance form, making sure it’s right and follows Ohio law.

- They do deep title searches to find any issues or liens on the property.

- They work with the cuyahoga county recorder’s office to record the deed and other documents.

- They help with understanding cuyahoga county recorder fees and other costs of the transfer.

While title companies offer many benefits, it’s important to think about the costs. Fees can differ, so it’s smart to shop around and compare prices. Knowing what services and costs are involved helps you make the best choice for your property transfer in Cuyahoga County.

Updates and Changes for 2025

As of 2025, Cuyahoga County will see many updates. These changes will affect property and real estate transfers. The Cuyahoga County recorder will be key in making these changes happen.

One big update is the new fee structure for documents. Starting January 13, 2025, fees for accounts, waivers, and motions will change. For example, filing fees for Estate, Trust, and Guardianship cases will be $50.00 for the first twenty pages. Each extra page will cost $1.00.

New Regulations

New rules will also shape how documents are filed. The Cuyahoga County Probate Court will have delayed openings for training. The court will also close on certain days.

Fee Structure Changes

The new fees will affect property and real estate transfers in Cuyahoga County. It’s important for those involved to know about these changes. The Cuyahoga County recorder will help with the transition.

Understanding these updates will help people navigate the transfer process better. The Cuyahoga County recorder will keep providing vital services to the community.

Conclusion

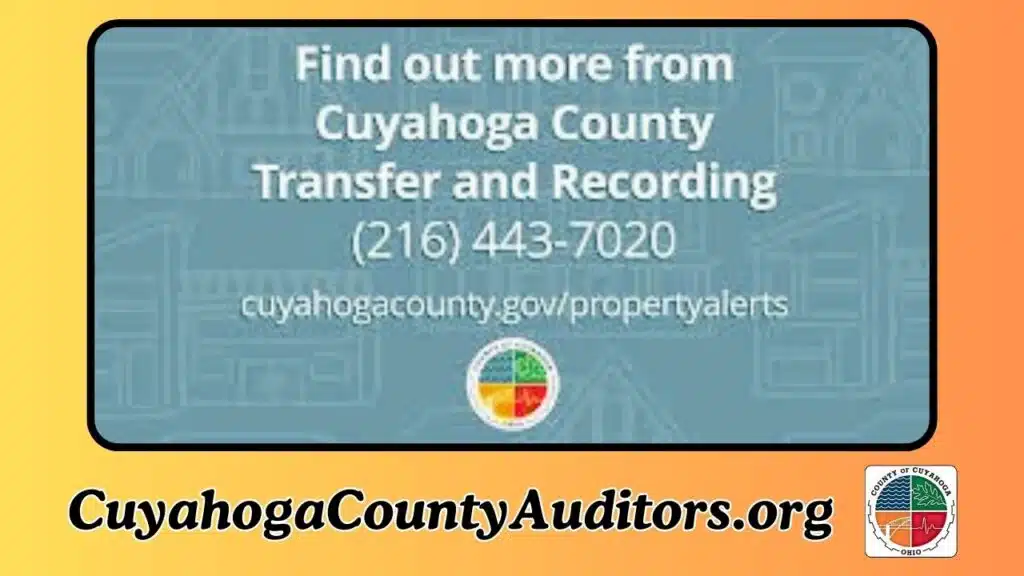

As we wrap up this guide on Cuyahoga County transfer recording, it’s key to remember the Cuyahoga County Recorder’s Office role. They make sure property transfers go smoothly. This guide has walked you through the legal needs and different types of property transfers in Cuyahoga County.

Being a homeowner, investor, or real estate pro means keeping up with transfer recording updates. The Cuyahoga County Recorder’s Office aims to offer quick and dependable services. It’s vital to know about any rule or fee changes that could affect your deals.

If you have more questions or need help, talk to a real estate lawyer or the Cuyahoga County Recorder’s Office. They can guide you through Cuyahoga County property transfers. Their knowledge ensures a smooth and worry-free process.

FAQ

What constitutes a property transfer in Cuyahoga County?

In Cuyahoga County, a property transfer is when someone sells or gives away a property to another person. This is a legal process.

What are the different types of property transfers in Cuyahoga County?

There are a few main types in Cuyahoga County. These include warranty deeds, quit claim deeds, and transfers involving businesses.

What is the role of the Cuyahoga County Recorder’s Office in the transfer recording process?

The Recorder’s Office in Cuyahoga County handles fees and checks documents for legal standards. They also give out info on property deals.

What are the essential documents required for transfer recording in Cuyahoga County?

You need deeds, conveyance forms, and other documents. They must be correct and complete for a smooth transfer.

What are the fees associated with transfer recording in Cuyahoga County?

Fees include a transfer fee and a conveyance fee. These costs depend on the property’s value and the deal’s details.

What is the DTE 100 form, and why is it important in the Cuyahoga County transfer recording process?

The DTE 100 form is key. It must be filed right and on time. It gives info on the transfer and tax exemptions.

How do quit claim deeds fit into the property transfer process in Cuyahoga County?

Quit claim deeds transfer ownership without warranties. They have special rules in Cuyahoga County.

What are the tax implications of property transfers in Cuyahoga County?

Tax implications include rates, calculations, and exemptions. Understanding these is vital during the transfer.

What digital recording options and online services are available for property transfers in Cuyahoga County?

Cuyahoga County has e-recording platforms and online services. They make submitting documents easy and quick.

What is the typical timeline for the conveyance process in Cuyahoga County?

The timeline has several steps and deadlines. Knowing these is key for a successful transfer.

Are there any special considerations for commercial property transfers in Cuyahoga County?

Yes, commercial transfers have extra rules. This includes business entity transfers that need attention.

What are the requirements for for sale by owner property transfers in Cuyahoga County?

For sale by owner transfers need specific documents and legal steps. These ensure the deal is legal and follows the law.

What are some common challenges that individuals may face during the Cuyahoga County transfer recording process?

Challenges include document issues, fees, and legal rules. Knowing the process and getting help when needed can help.

What is the role of title companies in the Cuyahoga County transfer recording process?

Title companies help with title searches and insurance. Their work can affect the cost of a transfer.

What updates or changes are relevant to the Cuyahoga County transfer recording process for 2025?

Stay updated on new rules, fee changes, and other updates. These can impact the transfer process in the future.