The Cuyahoga County Auditor’s Office is using advanced data analytics to improve property valuation. They use modern technologies and data insights to make property assessments more precise and fair. This ensures that property taxes are accurate, helping both homeowners and local governments.

In this article, we’ll explore how advanced data analytics is changing property valuation. We’ll look at its impact on the community and the tools the Auditor’s office uses for better accuracy.

What Is Data Analytics in Property Valuation?

Data analytics in property valuation uses statistical and computational techniques. It analyzes factors like historical data, market trends, and geographic information systems (GIS). This helps assessors identify patterns and predict market changes for more accurate valuations.

In Cuyahoga County, the Auditor’s Office uses cutting-edge technologies for precise property assessments. This ensures valuations reflect true market value and are unbiased.

How the Cuyahoga County Auditor Uses Advanced Data Analytics

1. Automated Property Valuation Models (AVMs)

The Cuyahoga County Auditor uses Automated Valuation Models (AVMs) as a primary tool. AVMs analyze data like recent sales, geographic information, and property characteristics. They use algorithms to calculate property values accurately and efficiently.

Key Components of AVMs:

- Real-Time Market Data: The AVM accesses the latest data about property sales in the county.

- Geographic Information Systems (GIS): GIS technology helps in understanding the location of properties, which can significantly influence their value.

- Comparable Sales Data: The AVM compares a property to recently sold properties in the same area with similar features, improving the precision of the valuation.

2. Geospatial Analysis for Location-Based Valuations

Geospatial analysis is a key part of the Auditor’s data analytics. It combines geographic data with property-specific information for accurate valuations. Factors like proximity to schools, public transportation, parks, and commercial areas impact a property’s value.

For example, properties near new infrastructure projects or in rapidly developing neighborhoods may see an increase in value. Properties in less desirable areas may experience a decrease. This analysis ensures valuations reflect the property’s surroundings.

3. Predictive Analytics for Future Property Trends

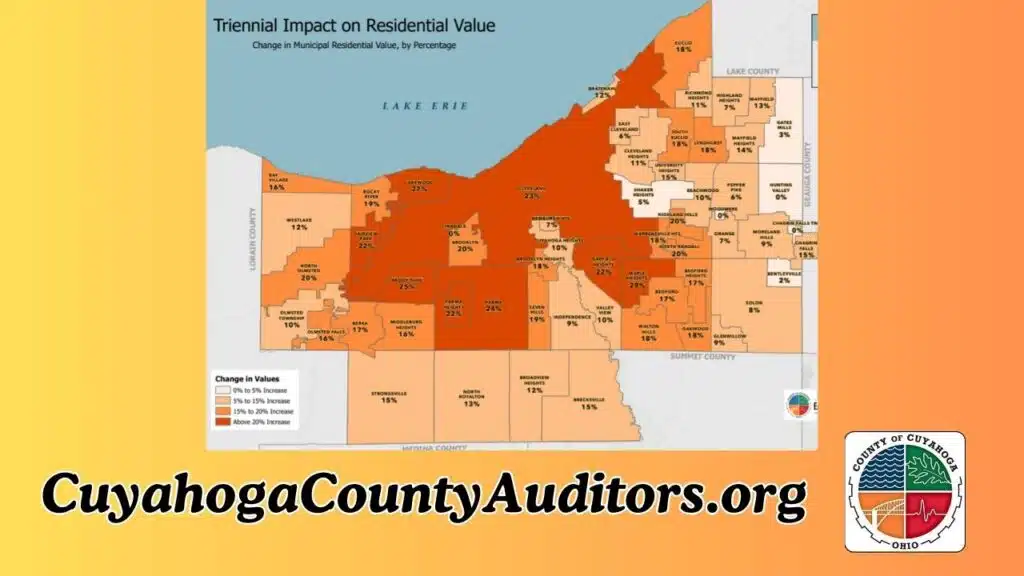

Predictive analytics forecasts future property trends using historical data. The Cuyahoga County Auditor’s office uses this tool to anticipate changes in property values. By analyzing property sales, interest rates, and economic conditions, predictive models help assessors make more accurate valuations.

Benefits of Predictive Analytics:

- Identifying Market Trends: Predictive analytics helps spot trends in the local real estate market, such as rising or falling home values.

- Better Resource Allocation: By understanding where property values are likely to change, the Auditor’s office can focus resources on areas that require more attention.

4. Big Data Integration for Holistic Valuations

The integration of big data allows the Auditor’s office to consider a vast range of data points. This includes local economic factors, demographic trends, and other external variables that might influence property prices. By incorporating this large volume of data, property assessors can create more accurate valuations.

5. Machine Learning for Continuous Improvement

Machine learning helps the Auditor’s office improve their valuation models over time. As more data is added, these models learn from past errors and adjust. This makes the system more accurate in predicting property values, leading to a better long-term strategy.

Advantages of Machine Learning:

- Adaptive Learning: Machine learning models get better with new data, making them very adaptable.

- Accuracy Over Time: With updates, the models find hidden patterns that improve valuation accuracy.

6. Public Transparency and Open Data

The Cuyahoga County Auditor’s Office is committed to transparency. They offer open access to property data and valuation models. This lets residents understand how their property taxes are determined, ensuring fairness in the assessment process.

Why Data Analytics Is Important in Property Valuation

Data analytics makes property valuation fair, objective, and based on real-time information. The more accurate the valuation, the more fair the tax burden is. Here are the main reasons data analytics is key in property valuation:

1. Increased Accuracy

Advanced data analytics boosts accuracy by reducing human error and biases. Algorithms quickly process vast data, allowing for more precise property values based on objective factors.

2. Fairness and Equity

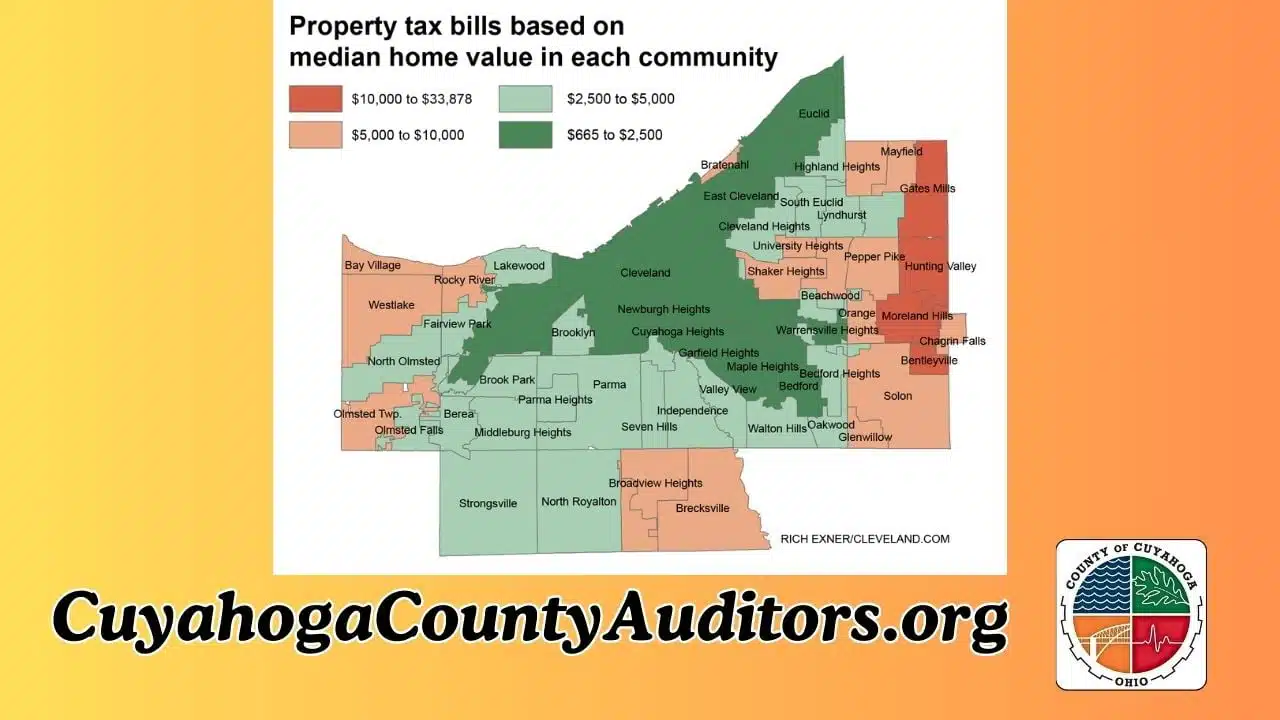

Data-driven models ensure property valuations are consistent and fair across the county. Property taxes are based on these valuations. Accurate assessments mean homeowners pay a fair share based on their property’s true market value.

3. Cost-Effectiveness

Using data analytics for property valuations saves time and resources. The Auditor’s office can assess properties more quickly and efficiently. This reduces costs and helps the county use its resources better.

4. Improved Decision-Making

Advanced analytics empower assessors to make better decisions. They use current market trends and predictive models. This helps the Auditor anticipate market changes and adjust valuations proactively.

How Cuyahoga County’s Property Valuation Process Works

Cuyahoga County’s property valuation process is complex but more efficient and accurate with data analytics. Here’s an overview of the typical steps:

- Data Collection: The first step is gathering data from various sources, including public records and property sales.

- Analysis Using Data Models: Advanced data models are applied to the data to determine the current market value of each property.

- Review and Adjustments: After the initial valuation, assessors review the results and make adjustments based on additional factors.

- Final Valuation and Notification: Once the valuation is finalized, property owners receive notification of their new assessment and tax rate.

Key Data Sources for Property Valuation in Cuyahoga County

| Data Source | Description |

|---|---|

| Real Estate Sales Data | Information on recent property sales to determine market trends |

| Geographic Data (GIS) | Geographic characteristics, including proximity to amenities, zoning info |

| Economic Indicators | Economic factors that influence property values, such as local employment |

| Demographic Data | Population growth, income levels, and household trends in the area |

| Property Characteristics | Data on property features, like square footage, year built, and upgrades |

Benefits of Advanced Data Analytics for Property Valuation

| Benefit | Explanation |

|---|---|

| Improved Accuracy | Data-driven models ensure precise property values based on objective data. |

| Increased Efficiency | Automated processes save time and resources for the Auditor’s office. |

| Fairer Property Taxes | Ensures equitable taxation based on accurate property assessments. |

| Transparency | Public access to data fosters trust in the property valuation process. |

| Predictive Capabilities | Anticipates future market shifts to keep valuations relevant and timely. |

Conclusion

The Cuyahoga County Auditor’s use of advanced data analytics has changed property valuation. They use tools like Automated Valuation Models and machine learning. This makes valuations more accurate, fair, and transparent.

This benefits homeowners by ensuring they pay fair property taxes. It also helps local governments keep their property tax system efficient and cost-effective. As data analytics gets better, Cuyahoga County will keep improving its property valuation processes.